Secret #1 Retirement Plan

Retirement, according to the dictionary, is to “withdraw from one’s position or occupation or from active working life.”

How To Develop a Retirement Plan

I was pretty lucky in some respects because due to illness I had to get all my affairs in order at age 60. I had no super but had just completed a great year in my business so had some small savings and had paid off all my debts. I had to start working on my Retirement Plan.

My Retirement Plan was simple. Get through the surgery and stay as healthy as possible. Reorder my life to be able to live on the pension without digging into my savings. I will do some work from home and my wife will get some casual teaching.

You can achieve your retirement plan when you have sources of income that can be sustained through residual income like interest, dividends or business related income, the pension or financial retirement plan with your super.

Retirement and the term “financial independence” are often used interchangeably.

For most people this happens at a predetermined time which in many countries is between the ages of 60 and 70. In Australia it is moving from 65 to 67 in increments of 6 months every 2 years. I was one of the first and needed to be 65.5 before retiring with a pension.

As a person who has just retired, I realize that it creeps up on many of us and after the initial surge of euphoria it can lead to loneliness, anxiety and depression. The main reason for this is our work provides a huge amount of stimulation both good and bad which is all of a sudden turned off.

The concept behind this book is to present you with a Retirement Plan and projects that can help soften the blow of your retirement whether rich or poor, man or woman and make it a fun and enjoyable experience.

Obviously there are many different roads to retirement and my aim is to provide you with the 52 secrets that will help you enjoy a great and interesting life.

Retiring from paid work is a major life change.

Lots of people hate this word “planning” however once embraced it will lead to a new outlook and a great deal of enjoyment.

Now I am going to use some of my experiences to help you understand the process of doing a retirement plan.

As a self employed person I did not have a lot of superannuation, properties, resources etc. mainly because I never thought I would get to this stage of life. Consequently my retirement plan happened when I got sick at around 60.

I was living overseas in Thailand running my business and doing charity work while my wife worked in a bilingual school teaching in English. She is also Australian.

On a trip back home I realised I was quite ill and after many tests with prodding and poking I was advised to have heart triple bypass surgery which I did in May 2013.

Having survived this and finding I also had diabetes life got a tad depressing and then to cap it all off in 2016 I found I had prostate cancer which was cut out in December.

Through the miracle of surgery my life has been extended and many changes made which we will look at in the future.

Over this time I realized it was time to make a retirement plan as our finances and business took a hit with all the down time and bills.

So don’t be like me being forced to make a retirement plan on the run, but do it now and save yourself the worry.

So these are the things I started on and we will break them down later:

- Food – for both health and finances

- Health – sustainability and health

- Finances – budgeting

- Accommodation – where to live

- Communications – Phones and Internet

- Transport – vehicle and travel

- Entertainment – very important

- Family – relationships

- Rest – not sedentary

- Centrelink

- Insurances

- Look in resources for links to budgets.

Lots of people think that having lots of money is the key to Retiring Successfully. The truth is it may make it more comfortable however in the end it’s more about relationships that have the greatest impact on the quality of your retirement.

This is also true for life in general. We had 4 boys and my wife made sure we had great holidays, they all travelled overseas and we did some great activities some of the best being volunteers at Sydney 2000 Olympics and volunteers for 20 years with Red Frogs.

Most of our life we were a one income family and I was not in the high echelons of business but mainly doing accounts and driving.

My one big investment was selling our house and buying a preschool with attached house in the late 80s. 1989 interest rates topped out at 24% and we got locked in for 2 years which sent us broke. We ended up selling but fell short of what we owed so was advised to file for bankruptcy.

We ended up buying a caravan in a caravan park and moved ourselves and the 4 boys in. One day I was sitting out the front crying as I had failed my family.

My eldest son came out and asked why I was crying to which I explained my failure. He looked at me and said this was the best place we had ever lived. Everyone at school wanted to sleep over as there was a river down the back with canoes, 3 acres of mowed lawn out the front for kicking balls and Frisbees plus tennis courts and a swimming pool.

I then realised its all about perception!

Plan on having strong social relationships, good health and a strong sense of purpose where you feel like a member of a community as this reaffirms your status in society. The lack of that status can be devastating.

As humans we have two basic needs. Significance and Security.

Three-fifths of lonely adults 60 and older had an increased risk of physical and mental deterioration than more social peers, according to a study by the University of California, San Francisco. They were also 45% more likely to die.

Retirement is much more than your savings (although you should surely save). Tend to the people in your life who mean something to you. Tend to your health. You’ll be happier for it.

If you have already retired and having some problems it is never too late to plan out your future as many of us will live on for many years.

Busy retirees tend to be happier retirees. One study showed that the happiest retirees engage in three to four regular activities and the retirees with the busiest schedules tended to be the happiest. So while retirement can certainly be a time to relax, it should also be a time to do the things you enjoy.

When planning just keep it simple and do a bit at a time and then implement.

As a lot of your time as a retiree will be waiting, develop a process that makes it easier to handle. Reading, games on your phone, meditating, writing etc.

Government Help

Whether you are an older Australian planning for retirement or continuing to work past pension age, the Government have payments and services to help with living costs.

https://www.humanservices.gov.au/individuals/subjects/age-pension-and-planning-your-retirement

Retiring from paid work is a major life change.

It’s a good idea to attend a free Financial Information Service (FIS) seminar to help with your retirement planning. FIS seminars provide information about preparing for retirement, understanding your pension and living in retirement.

https://www.humanservices.gov.au/individuals/services/financial-information-service

Talk to a FIS officer

Call 132 300 to speak to a FIS officer. If possible, your questions will be answered over the phone. If there are complex issues to be discussed, the FIS officer may offer to arrange an appointment for you.

Health Care Card

A concession card to get cheaper health care and some discounts if you’ve reached pension age.

Budget

The hardest part of any retirement plan is to budget. The govt once again provides a great online tool for working this out.

Tip: be honest with yourself.

Once you have worked out your budget you can then make adjustments to increase savings for a holiday or reduce payments to bring it into balance and have a sustainable life.

If you’ve saved well, you’ll want to be sure that your retirement funds last as long as you need them to. And if your finances are less-than-stellar, it’s even more important to budget, since you won’t have next week’s pay check to supplement financial mistakes.

I am one of the less stella retirees so I have done what is called a solar spread sheet which is 13 months instead of the traditional 12 month one. I get paid fortnightly so it makes a lot more sense.

I break everything into 13 months for example my car registration is $600 a year or $46 over 13 months or $23 every fortnight so I can budget to take this out so it is not a big hit at the end of the year.

I do the same with electricity, insurance etc. I use ING and have 2 accounts. A working account and savings account. My pension goes in every fortnight and then I take out the payments and transfer them into my savings account. This way I get better interest and no fees.

Willingness to be flexible with spending is “absolutely key” both before and during retirement, says Jon R. King, certified financial planner with Austin, Texas-based Pegasus Financial Solutions, LLC. “Spending before retirement is important because the less you spend, the more you save,” he says. “Cutting spending after retirement makes [your money] last longer.”

Here are 9 tips for predicting your retirement expenses.

You have a lot of options for how to tackle one of the most important aspects of retirement planning — predicting retirement expenses. It doesn’t matter too much which option you choose. What matters is that you create a plan that is detailed and personalized.

The NewRetirement retirement planner is perhaps the most comprehensive online tool available. Forbes Magazine calls it a “new approach to retirement planning” and the tool was named a best retirement calculator by the American Association of Individual Investor’s.

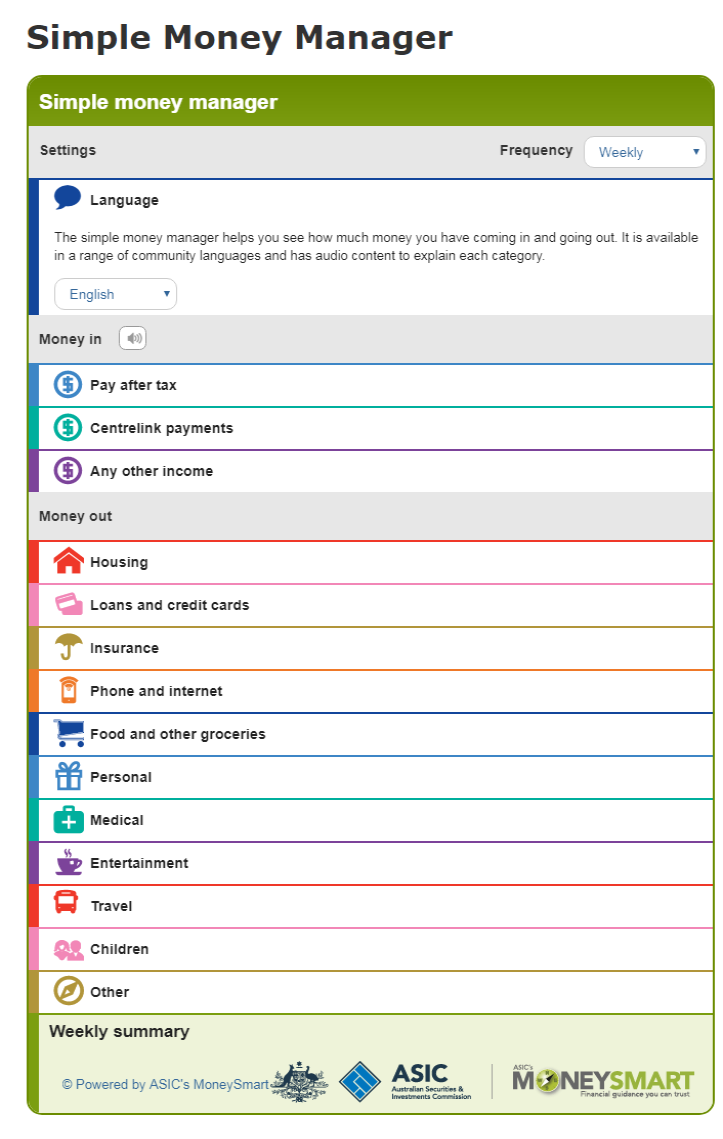

Use The Simple Planning Manager

Calculate how much money you have coming in. To do this, collect your:

- pay slips

- bank statements, and

- Centrepay Deduction Statement, if you use Centrepay.

Work out how much you’re spending. To do this, collect your:

- bills

- credit card statements

- receipts and shopping dockets

- costs for annual expenses, like insurance and car registration, even though you can pay them monthly.

You can then see how much money you have left over. You can use this for your savings.

Set a savings goal, that way you’ll know how much you need to save on a regular basis to reach it.

You can use the ASICs MoneySmart savings goals calculator on the how to build savings page to help you. It shows you how long it will take to reach your goal and how much you’ll need to save.

Remember to review your budget often to make sure it’s still working for you. A change in your income or ongoing expenses can affect your budget.

https://www.humanservices.gov.au/individuals/subjects/manage-your-money/how-budget#simplemoney