Secret #30 Entitlements

If you look up retiree mistakes on Google it can get depressing really fast. Not saved enough, not investing properly, in fact most will be financial.

Most of the companies say between 600 and 800 thousand per couple for a comfortable living if you can get 5% to 7%.

Failure to plan

One of the biggest mistakes is a failure to plan out your retirement which has been a key strategy in this book. The good thing is it’s never too late to plan no matter what stage of retirement you are in.

For finances do a simple budget to see if you are holding your own or going backwards and adjust. For everything else simply work out what you want and do a simple plan.

What are Your entitlements?

About 72% of respondents worried that Social Security would run out of money in their lifetimes. In fact, the annual report from the trustees for Social Security and Medicare indicates that even after the trust fund is exhausted (projected to occur around 2032) the payroll taxes paid into the system should pay indefinitely for about 70% of promised benefits.

This widespread belief that Social Security will run out of money might be why so few people take the time to understand the program and how to maximize their benefits.

The survey found large majorities were misinformed about basic features of Social Security. The result is they leave a lot of money on the table. Some experts estimate that it’s not unusual for married couples to lose out on $200,000 or so of lifetime benefits because of poor Social Security decisions.

“You must learn from the mistakes of others. You can’t possibly live long enough to make them all yourself.”– Sam Levenson

Every person saving for retirement or living in retirement must develop a certain level of financial skill so they can make wise decisions with their assets.

You must manage your savings withdrawals as an actuary, invest the savings to grow and produce the necessary income, and spend those savings to produce the greatest value and enjoyment.

You must learn how participate in savings plans, save the correct amount, and invest it wisely. Each of these skills requires financial literacy.

The sad truth is the data clearly show most people are ill prepared for these responsibilities. They lack financial literacy, causing them to perform poorly as actuaries, asset allocators, investment strategists, and long-term planners.

“More people would learn from their mistakes if they weren’t so busy denying that they made them.”– Unknown

The sad truth is the data clearly show most people are ill prepared for these responsibilities. They lack financial literacy, causing them to perform poorly.

This education isn’t optional because your retirement security is at stake.

You’re betting a lifetime of work and savings with every decision you make, so you must be able to navigate these waters effectively and with confidence as actuaries, asset allocators, investment strategists, and long-term planners.

Seniors cards

Generally if you are over 60 and work less than 20 hours per week, you can get a government seniors card, which offers discounts to a range of commercial businesses and some public services. Each state has their own eligibility rules so your state may be different. Here are the contacts for seniors cards in each state:

ACT – actseniorscard.org.au (02) 6282 3777

New South Wales – seniorscard.nsw.gov.au 13 77 88

Queensland – qld.gov.au 13 74 68

Victoria – seniorsonline.vic.gov.au 1300 797 210

Tasmania – dpac.tas.gov.au 1300 13 55 13

South Australia – sa.gov.au 1800 819 961

Western Australia – communities.wa.gov.au (08) 6551 8800

Northern Territory – dcm.nt.gov.au 1800 441 489

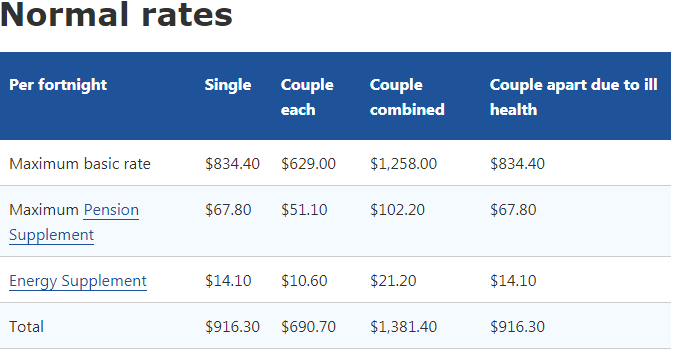

Payments for older Australians

https://www.humanservices.gov.au/individuals/subjects/payments-older-australians